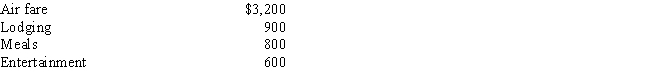

During the year,John went from Milwaukee to Alaska on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:

Presuming no reimbursement,deductible expenses are:

Definitions:

Total Revenue

The overall amount of money that a business receives from the sale of goods or services, calculated as the unit price times the quantity sold.

Additional Worker

An employee added to the workforce, often to address increased demand or enhance productivity.

Profit-Maximizing

The method or approach through which a company decides on the pricing and production quantity that yields the highest profit.

Marginal Revenue Product

The additional revenue generated by employing one more unit of a resource or factor of production.

Q25: The cost recovery basis for property converted

Q68: Regarding research and experimental expenditures,which of the

Q79: For all of the current year,Randy (a

Q82: Mason,a physically handicapped individual,pays $10,000 this year

Q98: The low-income housing credit is available to

Q100: During the year,Purple Corporation (a U.S.Corporation) has

Q105: For purposes of the § 267 loss

Q139: Once the actual cost method is used,a

Q218: Lily exchanges a building she uses in

Q263: Katrina,age 58,rented (as a tenant) the house