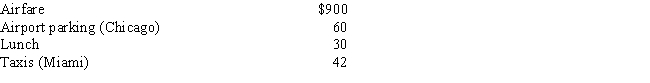

Alfredo,a self-employed patent attorney,flew from his home in Chicago to Miami,had lunch alone at the airport,conducted business in the afternoon,and returned to Chicago in the evening.His expenses were as follows:

What is Alfredo's deductible expense for the trip?

Definitions:

Unit Tax

A tax that is imposed on a per unit basis, meaning that a specific amount is taxed for each unit of a good or service sold.

Total Costs

The total of variable and fixed expenses a business faces during the manufacturing of products or delivery of services.

Inverse Demand Function

Expresses the price of a good or service as a function of the quantity demanded, illustrating how price varies with changes in demand.

Unit Tax

A fixed amount of tax imposed on a product or service, regardless of its price.

Q14: The § 179 deduction can exceed $510,000

Q16: White Corporation,a closely held personal service corporation,has

Q17: A taxpayer may not deduct the cost

Q25: A taxpayer who meets the age requirement

Q43: Taylor,a cash basis architect,rents the building in

Q59: An individual generally may claim a credit

Q77: A worker may prefer to be treated

Q94: Marvin lives with his family in Alabama.He

Q98: David earned investment income of $20,000,incurred investment

Q140: A moving expense deduction is allowed even