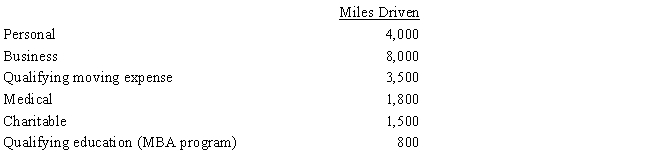

Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2017,his mileage was as follows:

How much can Rod claim for mileage?

Definitions:

Experienced Employees

Workers who possess a significant amount of knowledge and skill in their field or job, usually acquired through years of work and practice.

Operating Ratios

Metrics that measure the efficiency and profitability of a company's operations by comparing various expenses to net sales.

Industry Standards

Agreed-upon norms and specifications within an industry to ensure quality, safety, and efficiency.

Identifying Problems

The process of recognizing issues or obstacles that are hindering progress or success in a particular situation or environment.

Q11: A phaseout of certain itemized deductions applies

Q14: The § 179 deduction can exceed $510,000

Q21: Jack and Jill are married,have three children,and

Q26: In 2017,Kipp invested $65,000 for a 30%

Q44: A theft loss is taken in the

Q118: A LIFO method is applied to general

Q130: The amount of the addition to the

Q176: If the taxpayer qualifies under § 1033

Q198: Eunice Jean exchanges land held for investment

Q256: Liz,age 55,sells her principal residence for $600,000.She