Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

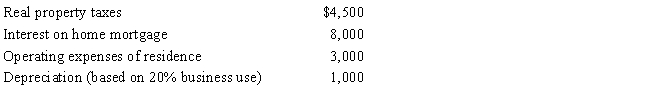

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business (i.e.,500 square feet).Gross income from the business is $13,000,while expenses (other than home office) are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a.If he uses the regular (actual expense) method of computing the deduction for office in the home?

b.If he uses the simplified method?

Definitions:

Earmarks

Funds that are directed to specific projects, beneficiaries, or locations, often within larger spending bills, typically by legislative provisions.

Logrolling

A practice in politics where two or more parties agree to vote for each other's proposed legislation or interests, often regardless of merit.

Marginal Benefit

The additional satisfaction or value gained from consuming or producing one more unit of a good or service.

Tax Cost

The financial charges associated with taxation, including the actual tax payment as well as any related compliance or administrative expenses.

Q4: Sue uses her own helpers.

Q51: Mary purchased a new five-year class asset

Q78: Linda,who has AGI of $120,000 in the

Q85: If a taxpayer does not own a

Q92: If a taxpayer operates an illegal business,no

Q97: In order to dissuade his pastor from

Q102: Kim dies owning a passive activity with

Q105: Gambling losses may be deducted to the

Q143: LD Partnership,a cash basis taxpayer,purchases land and

Q172: James has a job that compels him