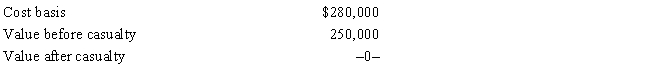

In 2017,Grant's personal residence was completely destroyed by fire.Grant was insured for 100% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:

What is Grant's allowable casualty loss deduction?

Definitions:

Transition Needs

The requirements or support necessary for individuals to effectively move from one stage or condition to another.

Audience-Member Family Activities

Activities involving family members as audience participants, typically in events like school plays, concerts, or sports games where they watch and support.

Expert Speakers

Individuals with a high level of knowledge or skill in a particular area, invited to talk or lecture based on their expertise.

Class Performances

The display or demonstration of knowledge, skills, and abilities by students during academic activities in a classroom setting.

Q5: During the current year,Ryan performs personal services

Q22: If a taxpayer operated an illegal business

Q29: Sadie mailed a check for $2,200 to

Q36: During the year,Eve (a resident of Billings,Montana)

Q49: Residential rental real estate includes property where

Q66: A physician recommends a private school for

Q73: Hazel,a solvent individual but a recovering alcoholic,embezzled

Q74: As a general rule:<br>I.Income from property is

Q94: Land improvements are generally not eligible for

Q168: Characteristic of a taxpayer who has the