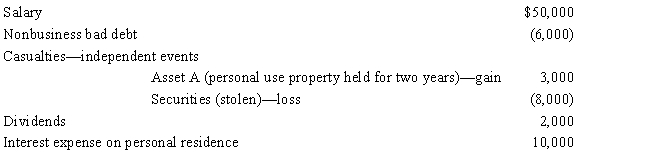

Mike,single,age 31,had the following items for 2017:

Compute Mike's taxable income for 2017.

Definitions:

Net Investment

The total amount spent by a company or economy on capital assets, minus depreciation, reflecting the increase in value of the entity's productive capacity.

Capital Stock

The total value of machinery, buildings, and equipment owned by businesses used to produce goods and services.

Gross Investment

Refers to the total amount of money invested in the creation of new capital assets in an economy within a specific time period, without deducting depreciation.

Corporate Taxes

Taxes imposed on the income or profit of corporations by the government.

Q29: Which of the following can be claimed

Q39: A corporation which makes a loan to

Q47: The amortization period for $58,000 of startup

Q53: Susan purchased an annuity for $200,000.She is

Q58: Taxable income for purposes of § 179

Q66: A taxpayer who itemizes must use Form

Q74: For tax purposes,a statutory employee is treated

Q77: A worker may prefer to be treated

Q131: There is no cutback adjustment for meals

Q137: Kelly,an unemployed architect,moves from Boston to Phoenix