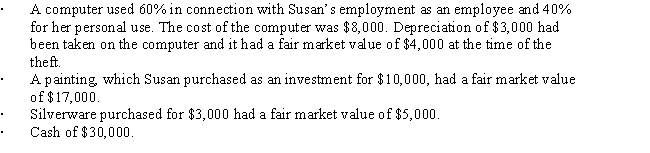

While Susan was on vacation during the current year,someone broke into her home and stole the following items:

Susan's adjusted gross income,before considering any of the above items,is $60,000.

Determine the total amount of Susan's itemized deductions resulting from the theft.

Definitions:

Organizational Director

A high-ranking individual within an organization responsible for overseeing operations, setting strategic direction, and making major decisions.

Equipment Upgrades

The process of updating or replacing old machinery, tools, or technology with newer, more efficient versions to improve operations.

Communication Technology

Tools and platforms used to facilitate exchange of information and communication, including digital and telecommunication devices.

Electronic Communications

The transmission of information using electronic technologies, including email, social media, and messaging services.

Q23: If a business retains someone to provide

Q34: If a vacation home is rented for

Q39: A corporation which makes a loan to

Q48: The Perfection Tax Service gives employees $12.50

Q64: A taxpayer takes six clients to an

Q79: For all of the current year,Randy (a

Q83: Two years ago,Gina loaned Tom $50,000.Tom signed

Q119: During the year,Jim rented his vacation home

Q123: Dick and Jane are divorced in 2016.At

Q126: Discuss the application of the "one-year rule"