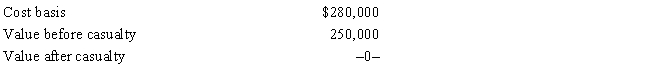

In 2017,Grant's personal residence was completely destroyed by fire.Grant was insured for 100% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:

What is Grant's allowable casualty loss deduction?

Definitions:

Racial Discrimination

The unfair treatment of individuals based on their race or ethnicity.

National Origin

The country where a person was born in, or where their ancestors came from.

Homosexuality

Romantic or sexual attraction or behavior between members of the same sex or gender.

Religious Discrimination

Unfair treatment of individuals or groups based on their religious beliefs or practices.

Q25: In 2017,Theresa was in an automobile accident

Q35: When the kiddie tax applies and the

Q50: As opposed to itemizing deductions from AGI,the

Q63: Deductible moving expense

Q67: Cora purchased a hotel building on May

Q78: Using borrowed funds from a mortgage on

Q83: On January 1,Father (Dave) loaned Daughter (Debra)

Q107: In 2017,Ed is 66 and single.If he

Q111: The period in which an accrual basis

Q116: Ordinary and necessary business expenses,other than cost