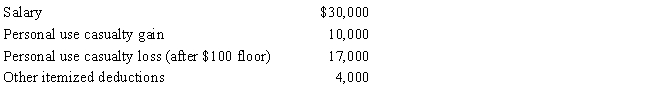

In 2017,Mary had the following items:

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for 2017.

Definitions:

Promissory Note

A financial document in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.

Accrued Interest

The interest that has accumulated on a debt over a period of time but has not yet been paid.

Promissory Note

A financial instrument containing a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

Net Credit Sales

The total value of sales made on credit minus any returns or allowances.

Q2: The § 179 limit for a sports

Q27: On June 1,2017,Gabriella purchased a computer and

Q32: Two-thirds of treble damage payments under the

Q59: Purchased goodwill must be capitalized,but can be

Q65: Fred is a full-time teacher.He has written

Q94: Land improvements are generally not eligible for

Q98: Sally and Ed each own property with

Q110: José,a cash method taxpayer,is a partner in

Q127: Tax home has changed

Q173: Taylor performs services for Jonathan on a