Essay

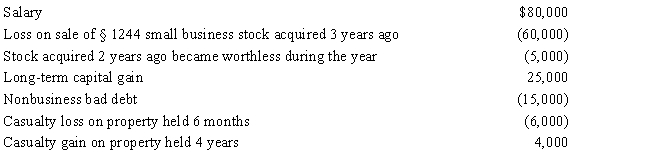

Maria,who is single,had the following items for 2017:

Determine Maria's adjusted gross income for 2017.

Definitions:

Related Questions

Q16: The current position of the IRS is

Q37: Payments by a cash basis taxpayer of

Q41: Under the Federal income tax formula for

Q75: A cash basis taxpayer took an itemized

Q76: James is in the business of debt

Q76: Sarah,a widow,is retired and receives $20,000 interest

Q81: Vail owns interests in a beauty salon,a

Q91: When the kiddie tax applies,the child need

Q101: During the year,John went from Milwaukee to

Q143: Ashley and Matthew are husband and wife