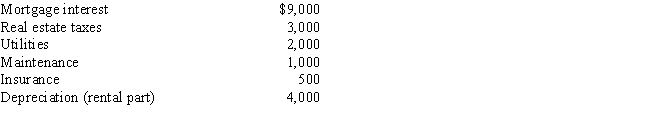

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Definitions:

Recognized Loss

A realized loss on investments or assets reflected in a company's financial statements.

Consolidation Process

The consolidation process involves combining the financial statements of separate companies, typically within the same corporate group, to form a single set of financial statements as if they were one entity.

Subsidiary

A company that is completely or majority-owned by another company, referred to as the parent company, which controls its operations and policies.

Convertible Bonds

Bonds that can be converted into a predetermined number of the issuing company's shares at certain times during their life, usually at the discretion of the bondholder.

Q3: Evan and Eileen Carter are husband and

Q18: Amy works as an auditor for a

Q22: Jacob and Emily were co-owners of a

Q28: Jim acquires a new seven-year class asset

Q38: Concerning the deduction for moving expenses,what circumstances,if

Q41: Carlos purchased an apartment building on November

Q77: A son lives with taxpayer and earns

Q77: The cost of repairs to damaged property

Q82: An individual may deduct a loss on

Q129: The portion of a shareholder-employee's salary that