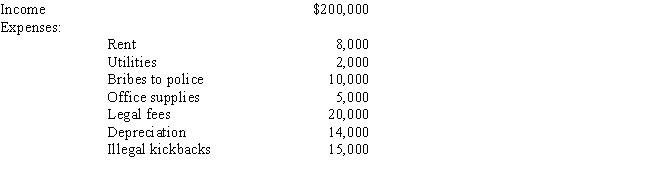

Kitty runs a brothel (illegal under state law) and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Definitions:

Direct Labor-Hours

The total hours worked by employees directly involved in the manufacturing process or providing a service.

Production Orders

Instructions or commands to start the manufacture of a certain quantity of a product within a specified timeframe.

Activity Rate

The rate determining the cost allocation in activity-based costing, which distributes overhead expenses to products or services according to particular activities.

Activity-Based Costing

A pricing approach that determines and allocates the expenses of each activity within an organization to all products and services based on their actual usage.

Q5: Ralph purchased his first Series EE bond

Q31: Grape Corporation purchased a machine in December

Q66: A loss from a worthless security is

Q75: Betty purchased an annuity for $24,000 in

Q86: Sammy,a calendar year cash basis taxpayer who

Q92: Ramon and Ingrid work in the field

Q97: All personal property placed in service in

Q143: Ashley and Matthew are husband and wife

Q157: A taxpayer who uses the automatic mileage

Q174: Meredith holds two jobs and attends graduate