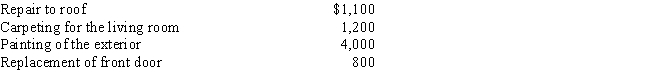

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Definitions:

Statement of Financial Position

A financial statement that shows the assets, liabilities, and equity of a company at a specific point in time, also known as a balance sheet.

Unrealized Profit

Unrealized profit refers to a profit that has been earned but not yet received or recorded through a transaction, often observed with investments that have increased in value but haven't been sold.

Consolidated Financial Statements

are financial statements that aggregate the financial position and results of an entity and its subsidiaries, presenting them as a single economic unit.

Ending Inventory

The total value of all inventory that a company has on hand at the end of its fiscal year, including goods ready for sale and those still in the production process.

Q19: Sue was trained by Lynn.

Q25: In 2017,Theresa was in an automobile accident

Q30: Turner,Inc.,provides group term life insurance to the

Q36: Alma is in the business of dairy

Q36: The IRS is not required to make

Q43: Taylor,a cash basis architect,rents the building in

Q84: Under the terms of a divorce agreement,Lanny

Q91: Which of the following events would produce

Q139: Once the actual cost method is used,a

Q145: For a vacation home to be classified