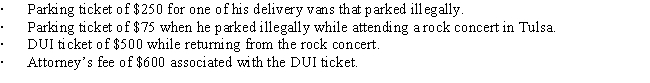

Andrew,who operates a laundry business,incurred the following expenses during the year.

What amount can Andrew deduct for these expenses?

Definitions:

Business Operations

The activities and tasks companies engage in on a daily basis to increase value for the business and its stakeholders, encompassing production, sales, and administration.

Fixed Assets

Assets of a long-term nature such as buildings, machinery, and equipment that are used in the operations of a business.

Share Exchange

A transaction where shareholders agree to trade their shares for shares of another company, often used in acquisition deals.

Shareholder Group

A collection of individuals or institutions that own shares in a corporation, giving them partial ownership and possibly the right to vote on corporate matters.

Q7: Tracy,the regional sales director for a manufacturer

Q28: How can an individual's consultation with a

Q28: What are the tax problems associated with

Q58: Automatic mileage method

Q76: Barry and Larry,who are brothers,are equal owners

Q90: Rhonda has a 30% interest in the

Q91: On August 20,2017,May placed in service a

Q129: Katelyn is divorced and maintains a household

Q160: Additional standard deduction

Q174: Meredith holds two jobs and attends graduate