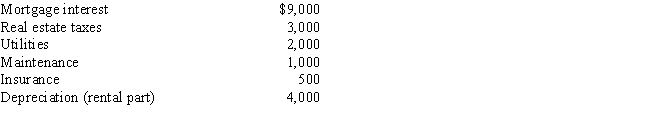

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Definitions:

Explicit Costs

Direct, out-of-pocket expenses paid by firms for inputs to production, such as wages, rent, and materials, as opposed to implicit costs which are not directly paid out in cash.

Implicit Costs

The opportunity costs that are not directly paid for or incurred during the production of a good or service.

Average Total Cost

The complete expenditure of manufacturing (incorporating steady and fluctuating expenses) divided by the aggregate volume of goods produced.

Output

The total quantity of goods or services produced by a company, sector, or economy within a given period.

Q16: Sue has unreimbursed expenses.

Q41: How is qualified production activities income (QPAI)

Q42: During the current year,Doris received a large

Q55: Ted was shopping for a new automobile.He

Q58: Jed is an electrician.Jed and his wife

Q58: In applying the $1 million limit on

Q68: Fresh Bakery often has unsold donuts at

Q75: Alicia was involved in an automobile accident

Q105: The taxpayer incorrectly took a $5,000 deduction

Q158: Job hunting expenses