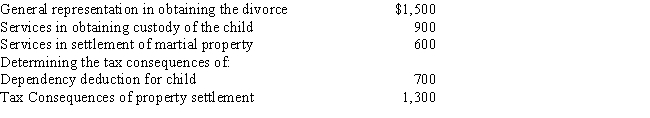

Velma and Bud divorced.Velma's attorney fee of $5,000 is allocated as follows:

Of the $5,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Definitions:

Knowledge

Facts, information, and skills acquired through experience or education, the theoretical or practical understanding of a subject.

Research Methods

Systematic strategies, techniques, and approaches used to conduct and analyze research.

Embodied Cognition

An approach to the study of cognition asserting that cognition is shaped and constrained by the context of the body of the organism experiencing the processing.

Evolutionary Approach

A perspective in psychology that interprets human behaviors and mental processes as adaptations that have evolved to increase survival and reproduction.

Q2: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q50: Rex,a cash basis calendar year taxpayer,runs a

Q83: Two years ago,Gina loaned Tom $50,000.Tom signed

Q88: On a particular Saturday,Tom had planned to

Q88: The basis of an asset on which

Q95: Meg's employer carries insurance on its employees

Q105: The taxpayer incorrectly took a $5,000 deduction

Q166: Lloyd,a practicing CPA,pays tuition to attend law

Q180: When can a taxpayer not use Form

Q187: Territorial system of taxation