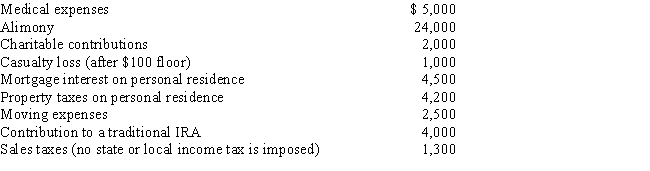

Austin,a single individual with a salary of $100,000,incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Definitions:

Immobilized

Made unable to move or incapable of being moved, often referring to the restriction of movement in a patient or part of the body for therapeutic reasons.

Circulation Impairment

a condition in which there is a reduction or blockage of blood flow in the body, potentially leading to various health complications.

Infection

The invasion and multiplication of microorganisms such as bacteria, viruses, and parasites that are not normally present within the body, often causing illness.

Bandages

Strips of material used to support, protect, or compress a part of the body, often used in the treatment of wounds.

Q1: If a business debt previously deducted as

Q15: Jay,a single taxpayer,retired from his job as

Q16: The taxpayer is a Ph.D.student in accounting

Q18: Identify the factors that should be considered

Q42: During the current year,Doris received a large

Q56: Nicole just retired as a partner in

Q61: Thelma and Mitch were divorced.The couple had

Q67: Cora purchased a hotel building on May

Q77: A son lives with taxpayer and earns

Q104: Which,if any,of the following is a correct