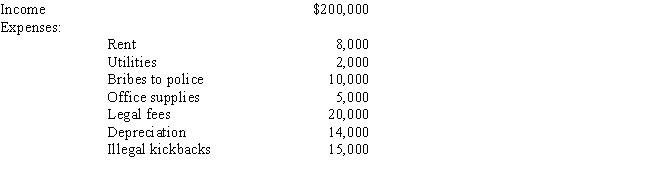

Kitty runs a brothel (illegal under state law) and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Definitions:

Unrealized Gain

Profits that have been earned on paper from an investment but have not been realized through a sale, and thus are not included in the income statement until realized.

Amortization

The gradual reduction of a debt or the allocation of the cost of an intangible asset over a period of time.

Fair Value Increments

Adjustments made to the book values of assets or liabilities to reflect their fair value at the time of acquisition in a business combination.

Bargain Purchase

A situation where the purchase price of a company is less than the fair value of its net identifiable assets.

Q17: The alimony rules:<br>A)Are based on the principle

Q34: Benny loaned $100,000 to his controlled corporation.When

Q42: In January 2017,Tammy purchased a bond due

Q54: Time test (for moving expenses) waived

Q74: As a general rule:<br>I.Income from property is

Q80: Paul is employed as an auditor by

Q83: George purchases used seven-year class property at

Q90: If personal casualty gains exceed personal casualty

Q93: Expenses incurred for the production or collection

Q115: In which,if any,of the following situations is