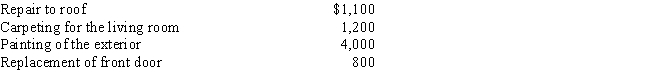

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Definitions:

Direct Channel

A distribution method where a company sells its products or services directly to its customers without the use of intermediaries or third parties.

High-School Glee Club

A musical group within a high school that performs a variety of songs, often including dance or theatrical elements.

Informal Channel

Unofficial, non-structured communication pathways used for the distribution of goods or information, often relying on personal connections.

Indirect Channels

These are pathways of distribution wherein goods or services move from the manufacturer to the consumer through intermediary agents or merchants.

Q19: Gary,who is an employee of Red Corporation,has

Q28: For the past few years,Corey's filing status

Q36: The IRS is not required to make

Q36: Which of the following is a required

Q40: Paula is the sole shareholder of Violet,Inc.For

Q63: The additional standard deduction for age and

Q125: Lena is 66 years of age,single,and blind

Q171: The major advantage of being classified as

Q173: Taylor performs services for Jonathan on a

Q178: Sue files a Form 2106 with her