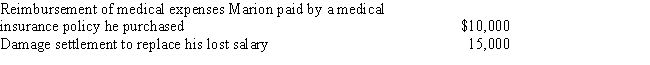

Early in the year,Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained,he received the following payments during the year:

What is the amount that Marion must include in gross income for the current year?

Definitions:

Creative Thinking

The process of thinking in new and unusual ways to come up with innovative solutions to problems.

Compliance Techniques

Strategies used to persuade or influence individuals to agree to requests or commands.

Authority

The power or right to give orders, make decisions, and enforce obedience, often within a specific context or organization.

Social Contagion

The spread of behaviors, emotions, and attitudes through a group or society via social influence.

Q3: Evan and Eileen Carter are husband and

Q24: On January 1,2017,Faye gave Todd,her son,a 36-month

Q25: The ratification of the Sixteenth Amendment to

Q34: If a vacation home is rented for

Q35: During the year,Walt travels from Seattle to

Q75: Alicia was involved in an automobile accident

Q90: Rhonda has a 30% interest in the

Q94: In determining whether an activity should be

Q111: Which,if any,of the following is a deduction

Q123: Dick and Jane are divorced in 2016.At