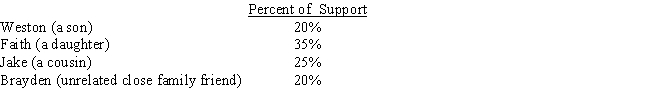

Millie,age 80,is supported during the current year as follows:

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

Definitions:

Straight-Line Depreciation

An approach to apportion the price of a tangible property over its effective life in consistent annual installments.

Machinery

Machinery refers to machines or machine systems collectively, which are used in various industries for manufacturing or other operations.

Calendar Year

The one-year period that begins on January 1st and ends on December 31st, used in most accounting and financial calculations.

Straight-Line Method

A method of calculating the depreciation of an asset, which assumes the asset will depreciate by the same amount each year over its useful life.

Q8: Sales made by mail order are not

Q43: A taxpayer can obtain a jury trial

Q66: A taxpayer who itemizes must use Form

Q77: Mauve Company permits employees to occasionally use

Q89: Teal company is an accrual basis taxpayer.On

Q94: Naples Company acquired all of the shares

Q95: An investor that has effective control over

Q103: Jim and Nora,residents of a community property

Q111: In 2017,Juan,a cash basis taxpayer,was offered $3

Q168: Heloise,age 74 and a widow,is claimed as