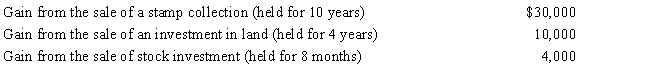

Perry is in the 33% tax bracket.During 2017,he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

Definitions:

Continuous Process Improvement

The ongoing effort to improve products, services, or processes through incremental and breakthrough improvements.

Japanese Management

A unique style of corporate management originating in Japan, emphasizing consensus, long-term employment, slow decision-making processes, and strong loyalty to the company.

Narrow Job Classifications

The practice of defining job roles and responsibilities in a highly specific and restricted manner.

Flexibility

The ability to adapt to new, different, or changing requirements, conditions, or situations.

Q1: Ted earned $150,000 during the current year.He

Q23: On January 1,2015,Bernie Company acquired 80 percent

Q26: In 2017,José,a widower,sells land (fair market value

Q67: Roy and Linda were divorced in 2016.The

Q77: On a classified balance sheet,the Equipment account

Q90: In preparing a tax return,all questions on

Q91: Isabella owns two business entities.She may be

Q99: An investor in available-for-sale securities has

Q100: Maude's parents live in another state and

Q166: Without obtaining an extension,Pam files her income