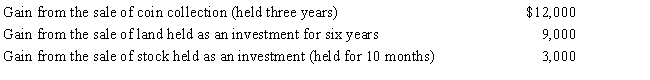

During 2017,Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Definitions:

Charitable Organization

A nonprofit entity that operates to perform charitable acts, provide education, religious, or public service activities, eligible for tax-exempt status under the IRS.

Charitable Deduction

A tax deduction that taxpayers can claim for donations made to qualifying charitable organizations.

Casualty Losses

Financial losses resulting from sudden, unexpected events like natural disasters, accidents, or thefts, potentially deductible under tax laws.

Deductible

is an amount that can be subtracted from an individual's gross income for tax purposes, reducing the taxable income.

Q13: The U.S.(either Federal,state,or local) does not impose:<br>A)Franchise

Q41: Under the Federal income tax formula for

Q46: Judy is a cash basis attorney.In 2017,she

Q66: The CEO of Cirtronics Inc.,discovered that the

Q79: On December 1,2017,Daniel,an accrual basis taxpayer,collects $12,000

Q94: The Dargers have itemized deductions that exceed

Q102: The company that owns 100 percent of

Q107: The objective of pay-as-you-go (paygo) is to

Q116: Accountants require investors that have control over

Q167: DeWayne is a U.S.citizen and resident.He spends