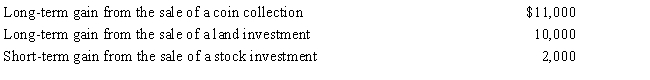

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2017:

Kirby's tax consequences from these gains are as follows:

Definitions:

Extinct

A term used to describe a species that no longer exists anywhere on Earth.

Reinforced

Strengthened or supported, especially in terms of structure, behavior, or beliefs.

Dishabituated

The process of responding to an old stimulus as if it were new again, typically after the stimulus has not been presented for a period of time.

Tiny Tots Day Care

A child care service specifically designed for the care and development of young children.

Q13: Perry is in the 33% tax bracket.During

Q25: Maroon Corporation expects the employees' income tax

Q27: At the beginning of 2017,Mary purchased a

Q27: Marsha is single,had gross income of $50,000,and

Q48: An investor holds 5% of the outstanding

Q52: Under the Swan Company's cafeteria plan,all full-time

Q71: Zork Corporation was very profitable and had

Q92: A tax cut enacted by Congress that

Q108: Return on sales equals gross profit divided

Q166: During 2017,Lisa (age 66) furnished more than