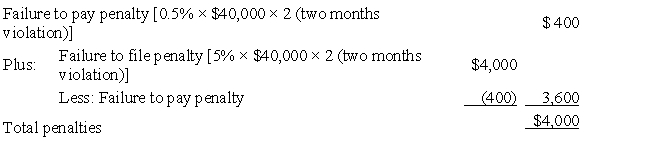

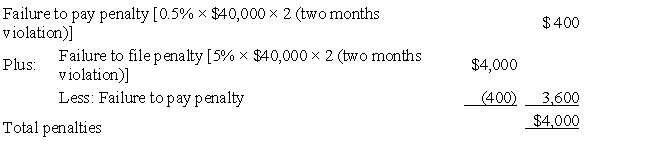

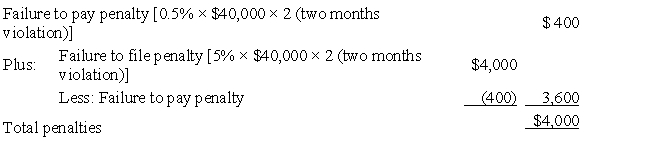

David files his tax return 45 days after the due date.Along with the return,David remits a check for $40,000 which is the balance of the tax owed.Disregarding the interest element,David's total failure to file and to pay penalties are:

Definitions:

Outpatient Treatment

Medical care or treatment given to patients who visit a healthcare facility but do not require overnight stay.

Problems in Living

Difficulties or challenges encountered in daily life that may affect one’s mental or physical well-being.

Anxiety and Depression

Mental health disorders characterized by persistent feelings of worry, anxiety, or fear, and pervasive low mood or loss of interest in activities, respectively.

Prevention

Actions or strategies aimed at stopping something undesirable, such as disease or adverse behaviors, from occurring.

Q7: In accordance with Generally Accepted Accounting Principles

Q48: The balance sheet is not linked to

Q51: Kiddie tax applies

Q60: Tim and Janet were divorced.Their only marital

Q88: Under the equity method of accounting for

Q101: Linda delivers pizzas for a pizza shop.On

Q111: The Middleton Company reports the following

Q112: On April 1,2012,Company X lends $200,000 to

Q120: Lucas,age 17 and single,earns $6,000 during 2017.Lucas's

Q182: As a matter of administrative convenience,the IRS