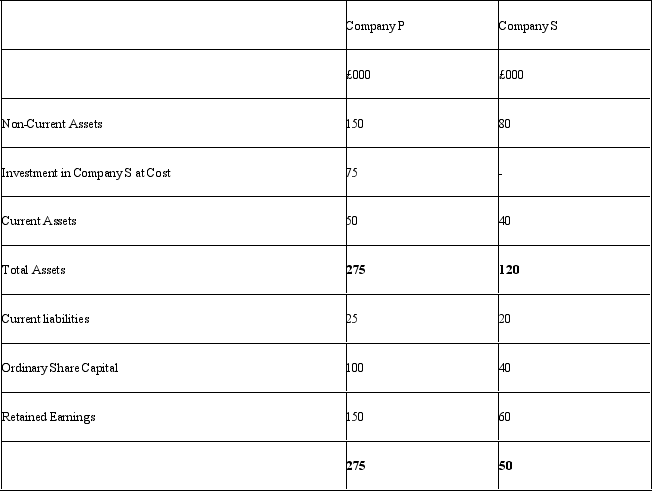

The Statements of Financial Position for company P and company S are shown below:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include,as well as 100% of the assets and liabilities of both companies:

Definitions:

Financial Leverage

The use of borrowed funds with a fixed cost to enhance the potential return on investment.

Bankruptcy Risk

The risk that a company will be unable to meet its financial obligations and thus may have to declare bankruptcy.

Operating Leverage

A measure of how sensitive a company's operating income is to a change in revenue, indicating the level of fixed versus variable costs.

Financial Leverage

The use of borrowed money to increase the potential return of an investment, which also increases the risk of loss.

Q4: Which of the following statements is false?<br>A)

Q8: In the Kauffman Center study of best

Q9: During the maturity stage of a venture's

Q12: The redemption of a loan would appear

Q16: A creditor account of £10,500 represents:<br>A) An

Q17: When there is an increase in a

Q20: Spellbound company make a sell 500,000 "wandies"

Q34: The firm's management style determines whether to

Q35: The first three stages of a successful

Q72: Indicate the number of principles of entrepreneurial