Use the following information to answer questions 10-12.

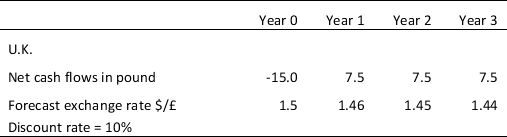

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

-Refer to Table 9.1.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Emotional Timing

The appropriate and strategic expression of emotions according to the situation, potentially affecting interpersonal relations and communication.

Selective Listening

A hearing and interpretation behavior where an individual focuses on certain parts of a conversation or message while ignoring others.

Anthony Allesandra

A prolific author and speaker known for his expertise in communication, sales strategies, and emotional intelligence.

Poor Listening Habits

Bad practices in listening that hinder effective communication, such as interrupting, not paying attention, or jumping to conclusions.

Q10: Tom's bank statements show he had an

Q12: Working capital may be defined as:<br>A) Current

Q19: Suppose that the one-year U.S.interest rate is

Q21: The Theory of Exchange Rate Overshooting explains

Q23: From the following information,calculate the cash

Q28: A central bank sale of _ to

Q35: An American firm has just bought merchandise

Q38: The fixed rate of currencies that will

Q38: In the presence of purchasing-power parity,if one

Q42: Under an assumption of perfect capital mobility,suppose