Use the following information to answer questions 10-12.

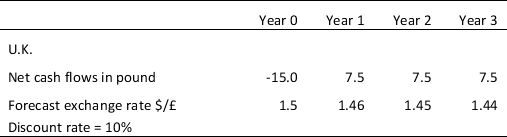

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

-Refer to Table 9.1.Based on the net present value,

Definitions:

Mexico

A country in North America, known for its rich cultural heritage, diverse landscapes, and significant contributions to world cuisine, art, and music.

European Union

A political and economic union of 27 European countries that are tied by a single market policy, allowing for the free movement of goods, services, capital, and people.

Euro

The official currency of 19 of the 27 European Union countries, also known as the Eurozone.

Trade Deficit

An economic circumstance where the amount a country spends on importing goods and services exceeds the amount it earns from exporting them.

Q2: Which of the following is considered a

Q5: Thunderstruck plc purchased £2,000 of inventory,paying £800

Q10: Referring to Figure 2.2,an increase in the

Q20: A company has the following costs of

Q25: A contractual obligation of a bank for

Q26: If opening stock for the year is

Q34: When the futures contract matures in September

Q35: In September,2005,exports of goods from the U.S.decreased

Q38: The fixed rate of currencies that will

Q40: The foreign exchange _ is the difference