Use this information to answer questions 13-15.

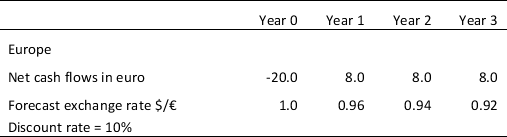

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Business Combination Valuation Entries

Journal entries that record the valuation of assets, liabilities, and contingent liabilities at fair value in a business combination.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the consumption of the asset's economic value.

Goodwill

An intangible asset that arises when a company acquires another company for a price higher than the fair value of its net assets, representing the value of the brand, customer relationships, and other intangible aspects.

Dividend Payable

A liability recognized on a company's balance sheet when it declares dividends to be paid to shareholders.

Q3: Which of the following statements is correct?<br>A)

Q4: What might you assume if a company

Q6: "Ethics" and an "Ethics Policy Statement" drawn

Q7: Which of the following statements is the

Q15: The manufacturing plant at Daydream plc

Q17: At the beginning of the financial year,trade

Q17: Which of the following would not form

Q19: Which of the following statements is false?<br>A)

Q20: Which of the following is not used

Q33: Which of the following statement is correct?<br>A)