Use the following information to answer questions 10-12.

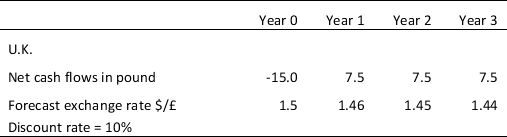

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

-Refer to Table 9.1.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Bonus Method

An accounting technique used to record the transactions related to the admission of a new partner into a partnership by revaluing the existing partners' capital accounts.

Profits and Losses

A financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a fiscal quarter or year.

Limited Liability Partnership

An agreement where a number of partners have their liabilities restricted, such that they are not individually accountable for the business's financial obligations.

Limited Liability Company

A flexible form of enterprise that blends elements of partnership and corporate structures, protecting members against personal liability beyond their investment.

Q8: Which of the following accounts would be

Q10: Economic order quantity means:<br>A) Ordering small quantities

Q20: Which of the following is not one

Q21: "Under the specie flow mechanism,a trade-surplus nation

Q24: _ exposure is the potential for an

Q25: "Following a shock to the equilibrium,prices will

Q25: The real exchange rate is equal to

Q31: Assume the following: the current spot rate

Q34: The six-month interest rate in the United

Q52: For an investor who starts with dollars