Use the following information to answer questions 10-12.

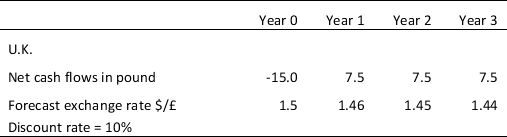

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

-Refer to Table 9.1.Based on the net present value,

Definitions:

Trade Restraint

Any measure or policy that restricts international trade, including tariffs, quotas, and embargoes.

Predatory Pricing

is a competitive strategy where a company sets extremely low prices to eliminate competition and create a monopoly.

Monopolist

A monopolist is a single supplier in a market that has significant control over the price and supply of a particular good or service.

Market Entry

The act or strategy of bringing a new product or service to the market, facing various barriers to entry.

Q2: ARR is expressed as: <br><br>A) <span

Q6: An example of a current liability is:<br>A)

Q7: Suppose that the covered interest parity holds.If

Q7: Which of the following statements is correct?<br>A)

Q10: Which of the following are potential indicators

Q10: Annual cash flows from a project are

Q11: With fixed exchange rates,a country cannot conduct

Q17: A company can reduce its reported salary

Q26: The MABP implies that the _ equals

Q36: Suppose that the one-year U.S.interest rate is