Use this information to answer questions 13-15.

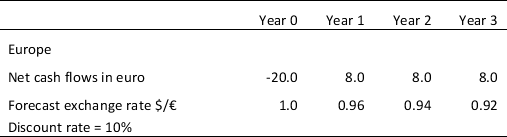

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

Definitions:

Closing Accounts

The process of finalizing all ledger accounts to prepare financial statements at the end of an accounting period.

Q2: Which of the following is not an

Q11: Depreciation is not a process of valuing

Q15: Due to the potential for dueling fiscal

Q20: If the opening balance on accounts receivable

Q20: If non-current assets are £250,000,current assets £70,000,long-term

Q23: Retained earnings do not contribute towards financing

Q24: A change in fiscal policy shifts the:<br>A)

Q24: Which of the following statements is correct?<br>A)

Q36: If the foreign exchange market is efficient,the

Q36: The following example supports which extension to