Use this information to answer questions 13-15.

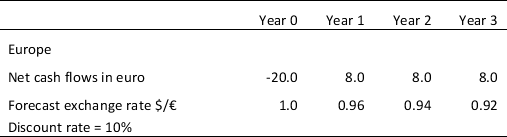

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.Based on the net present value,

Definitions:

Product Life Cycle

The stages a product goes through from development and introduction to the market, through growth and maturity, and eventually its decline.

Brand Elements

Characteristics that identify the sponsor of a specific ad.

Logo

A graphical symbol used to identify a company, brand, or product, often designed for easy recognition.

Slogans

Short, memorable phrases used in advertising campaigns to convey the essence of a brand or to promote products and services.

Q4: Suppose that the 1-year forward rate of

Q6: Systematic risk refers to the risk due

Q12: Which of the following is an argument

Q13: Which of the following is correct about

Q13: A high price/earnings (P/E)ratio suggests:<br>A) Shareholders are

Q20: Which of the following is not used

Q29: Which of the following statements is true?<br>A)

Q33: According to the _,the current exchange rate

Q44: High-inflation countries rarely see purchasing power parity

Q46: In general,the smaller the country is,the more