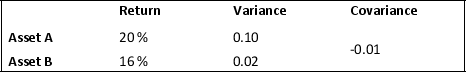

Use the following information for 14-15.

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

-See Table 10.1.If your portfolio includes a combination of 20% Asset A and 80% Asset B,then your expected return is:

Definitions:

Signature Liability

The legal responsibility that comes from the act of signing a document, indicating agreement or consent to its terms and conditions.

Liable

Responsible by law; legally answerable for one's actions or inactions.

Personally

Refers to something done by a person directly, without the involvement of anyone else or any intermediaries.

Proper Indorsement

A legally acceptable signature or annotation on a document, such as a check, that authorizes its transfer or acceptance.

Q4: Suppose that the one-year U.S.interest rate is

Q5: The structure of interest rates existing on

Q7: Suppose the central bank increases the money

Q12: During the currency contract period,if a devaluation

Q24: The Big Mac index is used as:<br>A)

Q29: Rather than directly issuing stock in the

Q36: A foreign currency option gives the purchaser

Q44: The return on the portfolio is a

Q50: What is the expected return of the

Q60: If the price of Japanese yen in