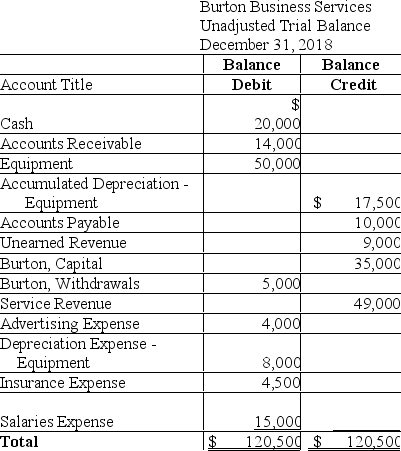

The unadjusted trial balance of Burton Business Services at December 31,2018,and the data for the adjustments follow:

Adjustment data at December 31 follows:

Adjustment data at December 31 follows:

a.Depreciation for the equipment is $4,000.

b.As of December 31,2018,Burton had performed services for Wilson Company for $3,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.

c.On August 31,2018,Burton agreed to provide consulting services to Allen Company for 6 months,beginning on September 1,2018,at $1,500 per month.Allen paid $9,000 on August 31,2018.Burton treats deferred revenues initially as liabilities.

Burton is preparing financial statements for the year ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

Definitions:

Employee Contributions

The portion of earnings that workers voluntarily allocate towards benefits like retirement plans or health insurance.

Universal Portability

A concept often related to social security or benefits systems, allowing individuals to retain their benefits or rights across different jobs, regions, or countries.

CPP

The Canada Pension Plan, a social insurance program requiring contributions from Canadian workers and employers to provide retirement, disability, and survivor benefits.

Q11: If an adjusting entry includes a debit

Q14: The formula for computing the current ratio

Q92: Which of the following entries would

Q112: Refer to the following adjusted trial

Q118: The Accounts Payable account of Waterford Company

Q121: Prepaid Rent is always classified as a

Q131: What type of account is Prepaid Rent,and

Q161: A balance sheet prepared in the report

Q192: On December 15,2018,Donald Services Company collected revenue

Q233: Which of the following line items will