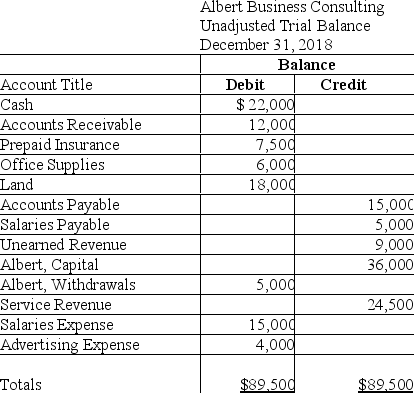

The unadjusted trial balance of Albert Business Consulting at December 31,2018,and the data for the adjustments follow:

Albert is preparing financial statements for the year ending December 31,2018.

Albert is preparing financial statements for the year ending December 31,2018.

Adjustment data at December 31 follows:

a.Albert pays its employees each Friday.December 31,2018 falls on a Monday.The employees will earn $1,250 for the five-day work week.

b.On August 31,2018,Albert agreed to provide consulting services to Smith Company for 6 months,beginning on September 1,2018,at $1,500 per month.Smith paid $9,000 on August 31,2018.Albert treats deferred revenues initially as liabilities.

c.Albert prepaid 6 months of business insurance on September 30,2018.The insurance begins on October 1.Albert treats deferred expenses initially as assets.

d.On December 31,2018,Albert received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is January 10,2019.

e.As of December 31,2018,Albert had performed services for Alliance Company for $5,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.Albert received the payment on its due date.

Requirement

1.Prepare the adjusting journal entries at December 31,2018.

2.Prepare the adjusted trial balance at December 31,2018.Include a proper heading.

Definitions:

European Conceptions

Ideas, perceptions, or interpretations that originated from or are commonly associated with European cultures or societies.

Kinship Group

A social unit based on familial ties, whether by blood, marriage, or adoption, forming a basic community structure.

Pilgrimage to Mecca

An annual Islamic pilgrimage to Mecca, the most holy city for Muslims; one of the five pillars of Islam requiring all Muslims who are able to undertake it at least once in their lifetime.

African King

A monarch or supreme ruler of an African kingdom, traditionally involved in the governance, cultural, and spiritual wellbeing of their nation.

Q4: The statement of owner's equity shows how

Q45: The balance sheet section of the worksheet

Q71: Van Jones is the owner of a

Q77: List the five steps of the journalizing

Q81: Freight in is recorded in the Merchandise

Q81: The first step in the journalizing and

Q122: Assets that are expected to be converted

Q141: Which of the following is classified as

Q143: The Salaries Payable account is a(n)_.<br>A) liability

Q161: Which of the following accounts would be