Modern Lifestyle Furniture began June with merchandise inventory of 45 sofas that cost a total of $31,500.During the month,Modern purchased and sold merchandise on account as follows:

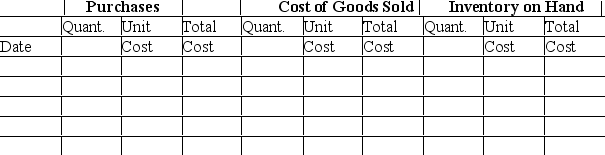

Prepare a perpetual inventory record,using the FIFO inventory costing method,and determine the company's cost of goods sold,ending merchandise inventory,and gross profit.

Definitions:

Trade-In Allowance

The amount deducted from the price of a new item for trading in something old.

Double-Declining Balance Method

An accelerated depreciation method that doubles the normal depreciation rate, reducing the asset's book value more quickly.

Depreciable Cost

The total cost of an asset that is subject to depreciation, typically considering its purchase price less any salvage value.

Estimated Useful Life

The expected period over which an asset remains usable to the owner, impacting depreciation calculations and asset management strategies.

Q9: Assets are listed in the order of

Q10: The lower-of-cost-or-market rule demonstrates accounting conservatism in

Q64: Better Deals Company has 6 units in

Q80: An enterprise resource planning (ERP)is a _.<br>A)

Q107: Which of the following inventory costing methods

Q120: Which of the following is NOT an

Q133: The cash payments journal has two debit

Q136: The current ratio shows the profitability of

Q185: Which of the following is NOT an

Q204: The current ratio measures _.<br>A) a company's