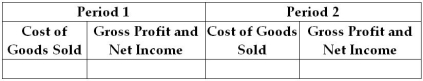

State the effects of inventory errors on cost of goods sold and net income for periods 1 and 2.The response should be overstated or understated.

Period 1 Ending Merchandise Inventory is overstated

Definitions:

Parental Philosophy

The set of beliefs and principles that guide parents in raising their children, often influencing parenting style and practices.

Behavioral Problems

Actions or behaviors by an individual that are disruptive, harmful, or outside of societal norms, often needing intervention.

Suppress Sexual Urges

The conscious or unconscious attempt to control or diminish one's own sexual desires and impulses.

Projection

A defense mechanism where one attributes their own unacceptable thoughts or feelings to someone else.

Q53: Collusion involves two or more people working

Q58: In a perpetual inventory system,multiple performance obligations

Q64: Better Deals Company has 6 units in

Q74: Cash purchases are recorded in the purchases

Q83: Entries in the sales journal are posted

Q88: Brownstone Company has a current ratio of

Q121: A company purchased 200 units for $40

Q129: Which of the following inventory costing methods

Q170: Internal control is an organizational plan that

Q172: The difference that arises between the balance