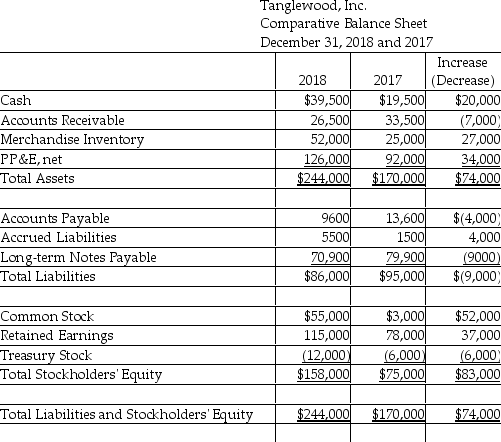

Tanglewood,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2018:  Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense.)

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense.)

Definitions:

Perfect Tender Rule

A principle in the Uniform Commercial Code allowing a buyer to demand a full compliance with the contract terms for goods.

Uniform Commercial Code

A comprehensive set of laws governing commercial transactions in the United States, designed to standardize and simplify the laws across the states.

Valid Title

A legal term indicating that a title to a piece of property is legally effective, with the holder having rightful ownership and no claims or outstanding liens against the property.

Clarify

To make a statement or situation less confused and more comprehensible.

Q45: When a company collects the face value

Q71: The rate of return on common stockholders'

Q87: Managerial accounting focuses on providing information for

Q92: For each of the following transactions

Q104: Depreciation on manufacturing equipment<br>A)Product cost<br>B)Period cost

Q133: A company reports total assets of $920,000

Q140: In 2018,Spirit Company's net income was 10%

Q166: LLL Company reported the following items

Q189: Which of the following is a reason

Q190: If a merchandising company determines that the