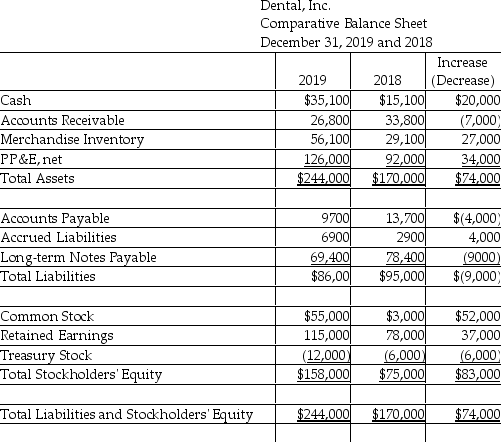

Dental,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2019:  Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense.)

Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense.)

Definitions:

Adrenal Cortex

The outer layer of the adrenal glands, producing vital hormones including cortisol and aldosterone.

Thyroid Gland

A butterfly-shaped gland located in the front part of the neck, responsible for producing hormones that regulate metabolism and energy generation.

Anterior Pituitary Gland

The front portion of the pituitary gland, which produces and releases hormones that regulate diverse body functions, including growth and reproduction.

Pars Nervosa

The posterior part of the pituitary gland, which releases hormones stored in axon terminals from the hypothalamus.

Q23: Which of the following is TRUE of

Q29: Which of the following statements is TRUE

Q38: The rate of return on total assets

Q75: Debt securities represent a credit relationship with

Q106: Managerial accounting information for a company is

Q120: Online financial databases provide data on companies

Q186: Generally accepted accounting principles require that interest

Q189: Which of the following is a reason

Q202: When a bond is issued,the issue price

Q206: Which of the following statements is TRUE