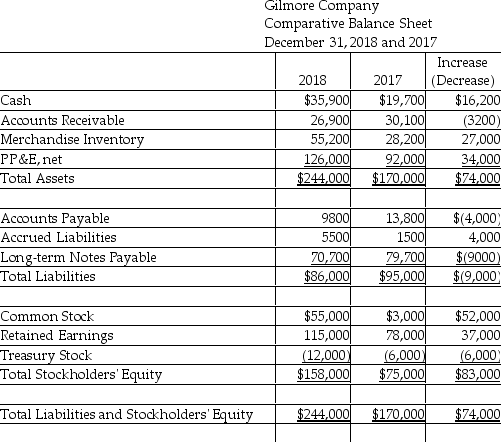

Gilmore Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2018:  Use the direct method,to compute the net cash provided by operating activities.(Accrued Liabilities relate to other operating expense.)

Use the direct method,to compute the net cash provided by operating activities.(Accrued Liabilities relate to other operating expense.)

Definitions:

Leader Behaviors

Refers to the actions and conduct displayed by leaders, encompassing various styles and strategies used to influence, motivate, and guide followers towards achieving goals.

Time Management

The process of organizing and planning how to allocate one's time between specific activities efficiently.

Managerial Work

Refers to the functions and activities performed by managers, including planning, organizing, leading, and controlling to achieve organizational objectives.

Early Contingency Theories

Theories suggesting that the effectiveness of a leader or management approach is contingent upon factors such as the organizational environment and task characteristics.

Q68: Candle Shop,Inc.has net sales on account of

Q86: The following information is available from

Q96: Identify how each of the following

Q96: In regards to benchmarking,which of the following

Q145: The cost of goods sold is added

Q172: Compute the present value of $46,000,invested

Q179: Optics Company uses the direct method

Q179: For each of the following accounts,indicate

Q191: The entire sequence of activities that add

Q228: Which of the following is a prime