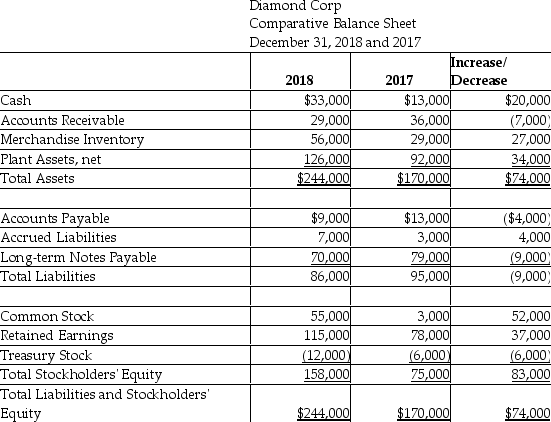

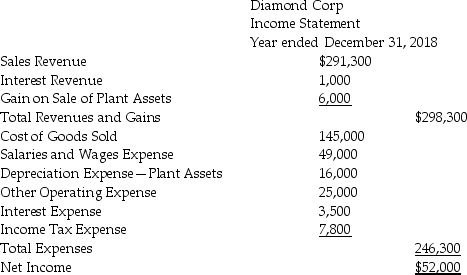

Diamond Corp.has provided the following information for the year ended December 31,2018.

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net book value of $10,000 was sold for $16,000.

Depreciation expense of $16,000 was recorded during the year.

During 2018,the company repaid $43,000 of long-term notes payable.

During 2018,the company borrowed $34,000 on a new long-term note payable.

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare the 2018 statement of cash flows,using the indirect method.

Definitions:

Branchlike Structures

Refers to dendrites, the extensions of neurons that receive signals from other neurons or sensory cells.

Dendrites

In a neuron, the branch-like extensions of the cell body that receive signals from other neurons.

Neurons

Specialized cells of the nervous system that transmit information to other nerve cells, muscle, or gland cells through electrical and chemical signals.

Receive Messages

The process of successfully perceiving or understanding messages communicated by others, through verbal or non-verbal means.

Q12: On July 1,2019,Montana Company has bonds with

Q14: For each of the following scenarios,state the

Q37: Cash borrowed on a mortgage note is

Q55: Short-term investments are investments in debt and

Q80: Knowing the unit cost per item helps

Q91: Wheat Corporation pays $532,000 for 100,000

Q105: Varda,Inc.used $213,000 of direct materials and

Q109: Star Health,Inc.is a fitness center in

Q130: Which of the following statements accurately describes

Q131: On July 1,2018,Jordie Equipment Dealer issued $600,000