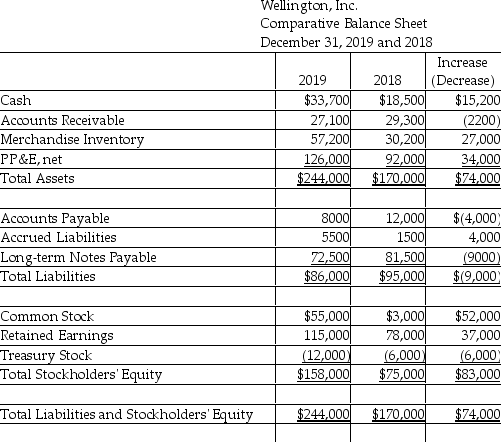

Wellington,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2019:  Use the direct method to compute the total cash receipts from operating activities.

Use the direct method to compute the total cash receipts from operating activities.

Definitions:

Trapezoidal Image

A digital or optical image characterized by a trapezoid shape, often as a result of perspective distortion in photography.

Retinal

Pertaining to the retina, the light-sensitive layer of tissue at the back of the inner eye.

Top-down Processing

An approach to perception that involves higher-level cognitive processes controlling lower-level systems, often utilizing pre-existing knowledge to interpret incoming information.

Sensory Adaptation

The procedure through which sense organs gradually become less responsive to persistent stimuli, permitting living beings to focus on variations within their environment.

Q5: Wisconsin,Inc.owed one of its creditors $350,000,but it

Q7: The fair value of an investment is

Q37: Days' sales in inventory measures how quickly

Q38: Colorado Company uses the indirect method

Q83: Which of the following is a part

Q133: A company reports total assets of $920,000

Q147: Creditors invest in a company and hope

Q165: State Street Beverage Company issues $805,000 of

Q191: The face value is $82,000,the stated

Q233: Seria,Inc.has received a bulk order from an