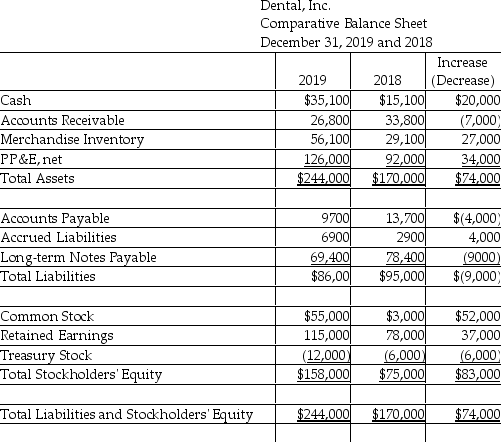

Dental,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2019:  Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense.)

Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense.)

Definitions:

Hopelessness

A feeling of despair and the belief that there is no possibility of a positive outcome.

Cognitive Variables

Factors within cognitive psychology that influence how an individual interprets, processes, and remembers information.

Retrograde Amnesia

A loss of memory for events that occurred before the onset of amnesia, often resulting from trauma or disease.

Suicide Cluster

When two or more suicides or attempted suicides nonrandomly occur closely together in space or time.

Q5: Pizza,Inc.provides the following data: <span

Q27: The United Way Payable account would normally

Q59: When would direct labor costs associated with

Q65: Companies that provide healthcare,communication,banking and other benefits

Q71: The rate of return on common stockholders'

Q97: Which of the following will be debited

Q105: The total amount of manufacturing overhead costs

Q112: In a manufacturing company,wages and benefits of

Q138: The profit margin ratio _.<br>A) focuses on

Q195: On January 1,2018,Western Services issued $20,000 of