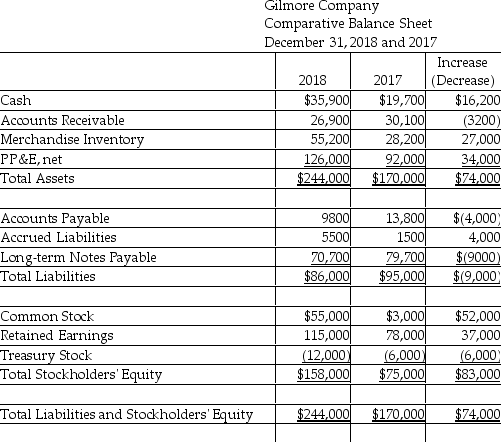

Gilmore Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2018:  Use the direct method,to compute the net cash provided by operating activities.(Accrued Liabilities relate to other operating expense.)

Use the direct method,to compute the net cash provided by operating activities.(Accrued Liabilities relate to other operating expense.)

Definitions:

Dichotomy Corollary

A principle in psychology, particularly within George Kelly's personal construct theory, suggesting that a person's construction system is composed of dichotomous constructs, meaning it is organized into two mutually exclusive categories.

Bipolar

A disorder characterized by episodes of mood swings ranging from depressive lows to manic highs.

Personality Theory

A branch of psychology that attempts to explain patterns of thoughts, feelings, and behaviors that make a person unique, through various theoretical perspectives.

Organizational Corollary

A principle related to how individuals structure and organize their perceptions and cognitions in a complex environment.

Q4: Oklahoma Corp.uses the indirect method to prepare

Q6: Which of the following would be included

Q16: Wyoming Company uses the indirect method

Q23: Managerial accounting includes the planning function.Which of

Q85: Georgia Corp.uses the indirect method to

Q118: Which of the following is a cash

Q133: Cash received from the issuance of notes

Q146: The role managers play when they evaluate

Q160: The owner of a bond or stock

Q191: Which of the following is TRUE of