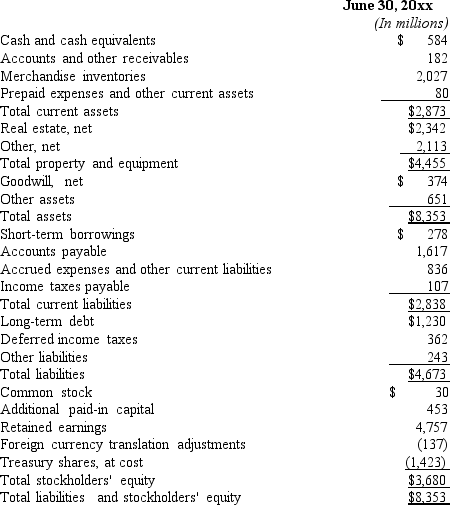

Using the following information from an annual report,prepare a vertical analysis of the consolidated balance sheet at June 30,20xx.(Round percentage answers to one decimal place.)

Definitions:

Violence Continuum

A conceptual framework that illustrates a range of behaviors from verbal abuse to physical assault, emphasizing the progression of violence.

Harassment

Unwanted or unwelcome behavior that aims to intimidate, offend, or degrade an individual or group.

Spreading Damaging Rumors

The act of disseminating false or malicious information about someone or something, which can harm reputations and relationships.

Aggression

Behavior intended to harm or intimidate others, which can be physically or verbally manifested.

Q11: What are the two steps in the

Q60: Marionette Company manufactures dolls that are

Q63: The proposals that will produce poor returns

Q65: Which of the following must be reported

Q73: Courtney Sinclaire is trying to rent a

Q76: Which of the following evaluation methods disregard

Q88: A major criticism of the payback method

Q123: Sundial Company manufactures and sells watches for

Q129: Motion Rollerblades has three product lines-D,E,and

Q153: Holiday Corporation provided these figures for the