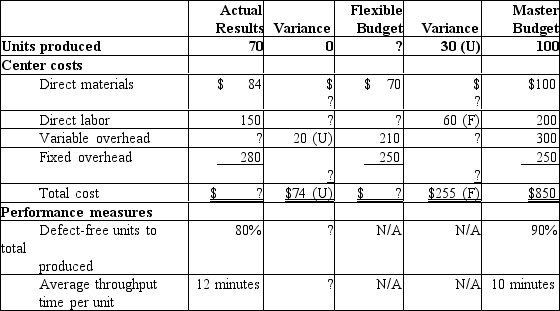

Use the following performance report for a cost center of the Dry Cat Food Division for the month ended December 31 to answer the question below.  What is the direct labor variance between the actual results and the flexible budget?

What is the direct labor variance between the actual results and the flexible budget?

Definitions:

Big Five

The Big Five is a model describing human personality traits through five broad dimensions: openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Personality Traits

Enduring characteristics or qualities that constitute an individual's unique and consistent patterns of feeling, thinking, and behaving.

Esteem Needs

Refers to the need for respect, self-esteem, and respect from others, constituting one of the higher levels in Maslow's hierarchy of needs.

Psychoanalytic Theory

A theoretical framework developed by Freud that emphasizes unconscious mental processes and childhood experiences in shaping behavior and personality.

Q2: The objective of segment profitability decisions is

Q9: J.J.Johnson has decided to supplement his income

Q11: Development of a transfer price involves<br>A) legal

Q32: Many organizations utilize responsibility accounting<br>A) to assist

Q36: In developing performance measures,management must consider which

Q43: Point Company uses the standard costing method.The

Q91: For purposes of computing EVA,the minimum desired

Q99: Distinguish between push-through and pull-through production methods.How

Q100: For work done during August,Printing Press Company

Q148: Xavier Products Company is in the process