Haskell,Inc.,reported the following income before income taxes,income taxes expense,and net income for 2009 and 2010:

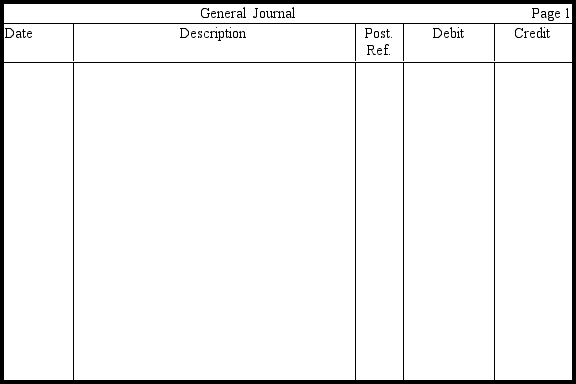

In 2009,Haskell deducted a $35,000 item for income tax purposes that was not deducted for accounting purposes until 2010.Haskell's marginal tax rate is 40 percent.Prepare entries in journal form without explanations to record Haskell's income taxes expense and income taxes payable for each year,assuming that income tax allocation procedures are used properly.

Definitions:

Great League Of Peace

An alliance of the Iroquois tribes, originally formed sometime between 1450 and 1600, that used their combined strength to pressure Europeans to work with them in the fur trade and to wage war across what is today eastern North America.

Iroquois

A historically powerful and influential group of Native American tribes in the northeastern United States, known for their sophisticated political system and the Iroquois Confederacy.

Centralized Authority

A system where decision-making and power are concentrated in a central group or location.

Q23: Jillian Harmon supervises 5 cashiers at Jack's

Q45: If net cash flows from operating activities

Q57: If a report is urgently needed,some accuracy

Q60: Convertible preferred stock is preferred stock that

Q79: Management accounting accumulates,maintains,and processes an organization's financial

Q97: Management accounting is not a subordinate activity

Q127: The par value of stock constitutes the

Q147: Bondholders are creditors of the issuing corporation.

Q157: Bowen Corporation had 39,000 shares of common

Q189: Compute the overhead rate per shipping request