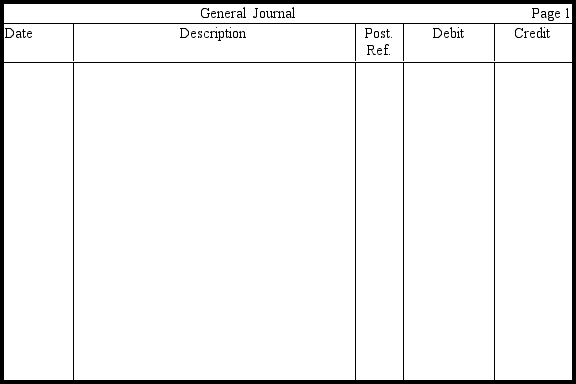

Haskell,Inc.,reported the following income before income taxes,income taxes expense,and net income for 2009 and 2010:

In 2009,Haskell deducted a $35,000 item for income tax purposes that was not deducted for accounting purposes until 2010.Haskell's marginal tax rate is 40 percent.Prepare entries in journal form without explanations to record Haskell's income taxes expense and income taxes payable for each year,assuming that income tax allocation procedures are used properly.

Definitions:

Circadian Rhythm

The innate, internal mechanism that controls the cycle of sleeping and waking, repeating about every 24 hours.

Power Motive

A psychological term referring to an individual's desire to exert control or influence over others.

Testosterone

A steroid hormone associated with the development of male secondary sexual characteristics, muscle mass, and bone density, also affecting mood.

Amygdala

A section of the brain's limbic system involved in emotion processing, fear response, and behavior regulation.

Q20: The balance of the Retained Earnings account

Q46: The equity method generally should be used

Q65: All of the following are indications of

Q77: Management accounting is the process of identifying,measuring,accumulating,analyzing,preparing,and

Q79: Royer Corporation engaged in this transaction: Purchased

Q98: Return on equity is measured in terms

Q131: Use the following information to answer

Q146: The advantages of financial leverage accrue primarily

Q154: In a monthly mortgage payment,the same amount

Q162: Sugar Company owns 100 percent of the