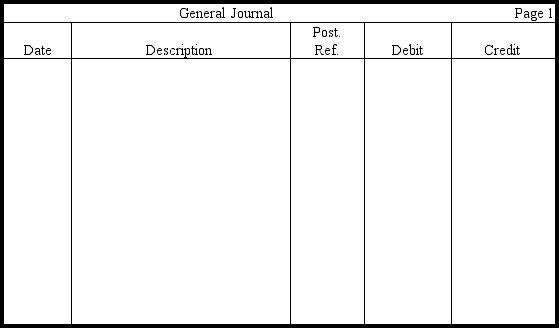

The following transactions and information pertain to Langston Corporation for 20xx.Prepare entries in journal form,without explanations,to record these transactions.

Definitions:

Long Position

Holding an asset or security with the expectation that it will increase in value over time, reflecting an investment strategy based on anticipated price growth.

Treasury Bonds

Long-term government securities issued by the U.S. Treasury with a maturity period typically between 20 to 30 years.

Interest Rate Futures

Financial derivatives that allow investors to bet on or hedge against future changes in interest rates.

Sell

The action of offloading an investment from one's portfolio, typically with the goal of realizing gains or limiting losses.

Q12: Book value per share refers to the<br>A)

Q34: When interest payments on an investment exceed

Q48: Orlov Corporation purchased 8,000 shares of

Q68: When bonds are called for retirement,any excess

Q68: Eliminations are important because they avoid double

Q100: Coll Company (the parent company)manufactured a product

Q114: Available-for-sale debt securities are valued on the

Q121: The Chief Financial Officer (CFO)of your company

Q149: Assume the indirect method is used to

Q157: Bowen Corporation had 39,000 shares of common